Northwestern Mutual Select Deferred Income Annuity Review

by Joe Signorella, RICP® Updated: 9-15-2021

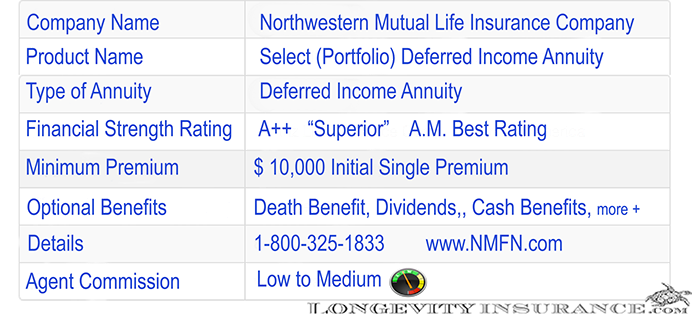

Baby Boomer's age sixty-five and over number around forty million, which increases over thirty seven percent to fifty five million by the year 2020 according to the US Census Bureau. Northwestern Mutual recognized that this growing demographics want income for later in life. Northwestern Mutual Life Insurance is the second-largest deferred-income annuity provider in the US and has introduced the Select Deferred Income Annuity. This longevity annuity , longevity insurance and also called a QLAC is one of the first longevity annuities from a Mutual life insurance company. Others include New York Life, Mass Mutual, Pacific Life and Guardian Life.

Capitalizing on their mutual life status of paying dividends they have added a new version called the “Portfolio” or named Select Portfolio Deferred Income Annuity. This Portfolio series allow dividends to be paid to the policyholder just like a mutual permanent life insurance policyholder would receive.

Dividends are distributions of the insurance company’s surplus from premiums plus investment income that are more than the insurance company’s operating expenses. The amount or existence of a dividend is not guaranteed on any policy in any given year but usually paid annually.

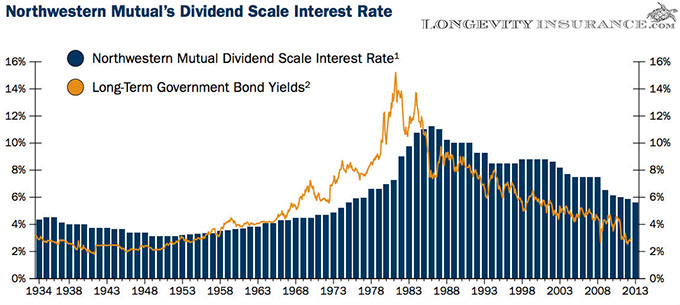

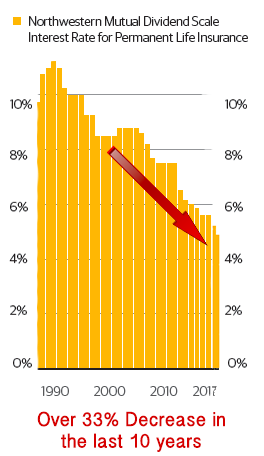

Dividends for Northwestern Mutual qualifying longevity annuity contract set them apart from other longevity annuities on the market. However it is hard to determine if and by how much they will credit a dividend on this annuity type.  Northwestern Mutuals life product dividend for the last five years has declined each year. 2010 dividend scale rate was 6.15%, 2011 was 6.00%, 2012 was 5.85%, 2013-2015 was 5.60% each year, 2016 lowered to 5.45%, and 2017 is 5.00% and lastly lowered to 4.9% in 2018 the lowest rate in 40 years. That is over an 33 percent decrease in the last ten years. Look at the fine print in the brochure that states the following. “Due to the unique characteristics of this product, the dividend scale interest rate for this contract is NOT expected to be the same as the dividend scale interest rate for most traditional life insurance policies. In addition, during the first 10 years of the contract, the dividend scale interest rate for this contract will be subject to a dilution adjustment, which will likely result in a reduction to what the rate would otherwise be.” You can take this fine print statement as the first ten years of your longevity annuity the dividend scale rate will be lower than the quoted rates above which will further lower your retirement income.

Northwestern Mutuals life product dividend for the last five years has declined each year. 2010 dividend scale rate was 6.15%, 2011 was 6.00%, 2012 was 5.85%, 2013-2015 was 5.60% each year, 2016 lowered to 5.45%, and 2017 is 5.00% and lastly lowered to 4.9% in 2018 the lowest rate in 40 years. That is over an 33 percent decrease in the last ten years. Look at the fine print in the brochure that states the following. “Due to the unique characteristics of this product, the dividend scale interest rate for this contract is NOT expected to be the same as the dividend scale interest rate for most traditional life insurance policies. In addition, during the first 10 years of the contract, the dividend scale interest rate for this contract will be subject to a dilution adjustment, which will likely result in a reduction to what the rate would otherwise be.” You can take this fine print statement as the first ten years of your longevity annuity the dividend scale rate will be lower than the quoted rates above which will further lower your retirement income.

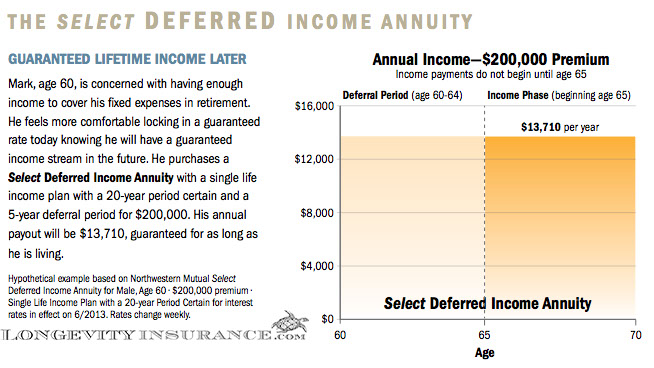

Lets take a closer look as to how the two different types of longevity annuities Northwestern Mutual work. The more traditional longevity insurance is called Select Deferred Income Annuity. It would be comparable to others on the market like Pacific Life and AIG. Help finding quotes to compare rates at www.QLACQuote.com. The “Select” is a straight single premium deposit in exchange for a set annual/monthly income stream set by the insurance company. This is available as a QLAC (Qualifying Longevity Annuity Contract). Hypothetical example based on Northwestern Mutual Select Deferred Income Annuity for Male, Age 60, $200,000 premium, Single Life Income Plan with a 20-year Period Certain. Yearly guaranteed income amount $13,710. No dividends or cash value given in addition to the $13,710 per year. Northwestern Mutual gives us a little bit lower income streams than other insurance carriers deferred income annuities on the market.

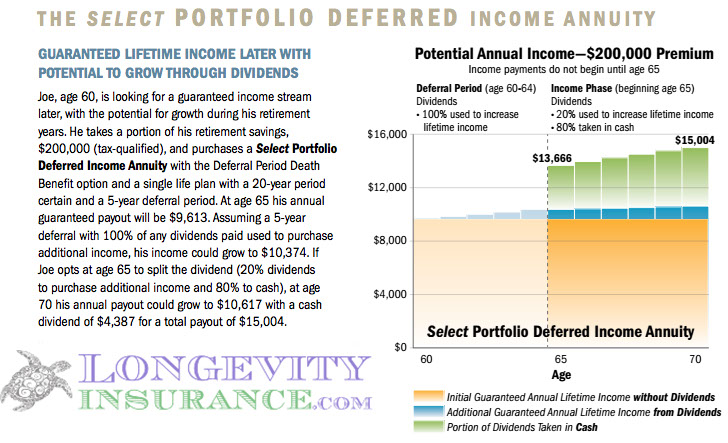

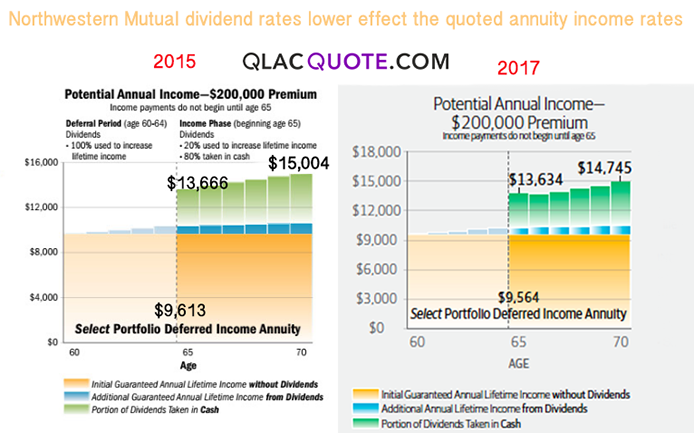

The “Portfolio” or Select Portfolio Deferred Income Annuity has three parts to its income stream. It is not available as a QLAC as the Treasury rulings doesn't allow dividends which violate the Qualifying status of the QLAC. First part is the traditional longevity lifetime income stream. Second part is the optional cashing in of dividends each year. The last part is the dividend being exchanged for additional longevity lifetime income each year. Hypothetical example for Male, Age 60, $200,000 premium, Single Life Income Plan and a 20-year Period Certain. The example shown below includes non-guaranteed dividends. The illustrated dividend scale is based on a dividend scale equal to the 2015 dividend scale of 5.6%. Illustrated dividends are not estimates or guarantees of a future result.

The only guarantee income payment would be an annual $9,613 in 2015. The blue dividend portion would increase the age 65 annual payment to $10,374, which is far below the Select deferred income annuity starting income payment of $13,710. You are counting on the non guarantee dividends, dividends staying at the same 5.6% rate and cash out income payment far in the future. Northwestern Mutual has a history of suspending a divided in any given year, like is did in it's long term care insurance product. The Long Term Care and Longevity Annuity policies are held in separate "pools" for the dividend crediting at Northwestern Mutual. Having a small history of dividends and actuarial struggles with mortality may cause dividend paying in the future. Too much non-guarantee variables for your pension like retirement income that you are counting on years in the future.

The graph below shows the 2015 illustration chart used in 2015 with projected income payments going out ten years to age 70 at $15,004 per year with the Select portfolio deferred income annuity versus the current 2017 illustrated chart in the northwestern mutual client brochure with income rates lower to $14,745 per year. This is the concern that you should have; the dividends are not guaranteed and could potentially be lowered than quoted given the non-guaranteed status.

To keep up the with rising costs in retirement Northwestern Mutual’s Select Deferred Income Annuity has the “Portfolio” type which would take the place of a more tradition COLA or cost of living adjustment feature. You also have one time option to change the start date of your income by five years along with an optional death benefit before your income start date to refund your deposit before income starts. Northwestern Mutual also markets a Select immediate income annuity (SPIA) of the recently launched Northwestern Mutual Retirement Investment Strategy.

Fees:

The agent will receive a front load commission closer to 4%-5% of initial deposit of funds. Since deposits at Northwestern Mutual are not held in a separate account there is no ongoing fees to manage the funds held at the insuring company.

How to use this annuity in retirement planning?

Have your constant lifetime income cover your basic expenses in retirement. This would include any Social Security, pensions, and annuity income. Studies have shown that converting a small portion, less than 50%, of your retirement funds to an income annuity will increase your portfolio income success rate over a 20-year time frame. By eliminating stock market sequence of returns risk with a purchase of Northwestern Mutual Select Deferred Income Annuity will produce lifetime income in retirement that cannot be outlived. The Portfolio version is untested and already at a disadvantage with the statement above regarding the ten year reduction in dividend scale payout. Nice idea for the dividend payments but wait until it has a proven dividend paying track record until you invest your nest egg.

Disclosure:

This is an independent annuity product review and it does not constitute any type of recommendation to purchase or sell an annuity. This annuity carrier has not endorsed this review in any way, and I do not receive any compensation for providing this review. This information is meant to be an independent opinion showing the potential advantages and/or drawbacks of this particular financial vehicle, and how it may or may not fit into their specific financial plan. Prior to engaging into any financial products, it is important to pursue your own due diligence and to consult with a properly licensed financial professional, preferably a Certified Financial Planner practitioner before moving forward. All names, trademarks, and materials that were used in this annuity review are the property of their respective owners.

Article by Joe Signorella, RICP®

Joe Signorella+ is a Retirement Income Certified Professional® specializing in retirement income planning. He has over a decade and a half of experience and is the CEO/Founder of LongevityInsurance.com. Joe also is one of the first five hundred Retirement Income Certified Professional® in the world. He's seen first hand the increase in retirement income by including a deferred income annuity and encourages everyone to get a free income annuity quote today. Have a question? Call toll-free: 1-800-325-1833

FREE Retirement

Income Quote