Call us:

%20transp.png?crc=174519215)

Home > Get Informed > Longevity insurance FAQ

Longevity Insurance FAQ

What is Longevity Insurance?

Is a contract between an insurance company, usually in the form of an annuity contract, designed to pay a guaranteed lifetime income later in life to the policyholder or annuitant. This guaranteed income stream can be established if he or she survives to a pre-established future age, usually age 80 to 85.

When does Income Start?

Longevity insurance is deferred income annuity which means you have to wait at least 13 months for income to start. To maximize your deferred income age 80 or 85 is a standard commencement withdrawal age.

Why Buy Now?

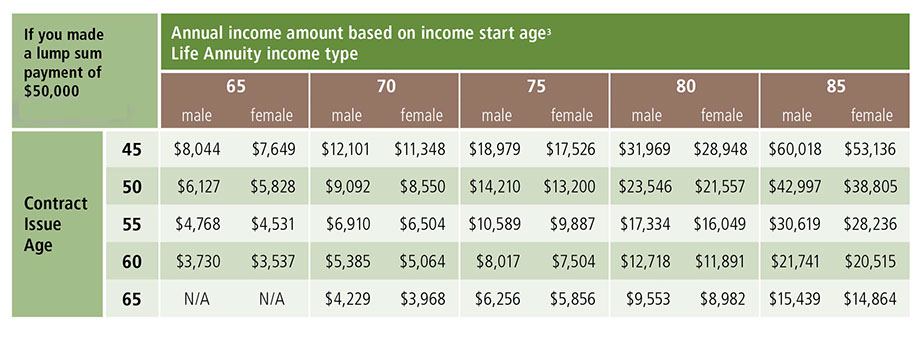

By purchasing Longevity insurance sooner and/or waiting to take income, you can receive more guaranteed income. The chart below, making purchase payments just 10 years earlier (age 45 vs. 55 or age 55 vs. 65) can almost double your income at age 85. Making purchase payments 20 years earlier (age 45 vs. 65) will more than triple your future income. In addition, waiting just 5 more years to take income (from age 80 to age 85) can mean a payout of nearly twice as much, regardless of when you purchase your longevity insurance contract.

Hypothetical Example. For Illustrative Purposes Only.

What Withdrawal Income Options are Available?

Life with Period Certain – Payments begin on the income start date and are guaranteed for a minimum period of time (10–30 years). If the policy holder lives longer, however, they’ll continue to receive payments for their entire lives.

Life with Cash Refund – Payments begin on the income start date, but upon policy holder's deaths, beneficiaries will receive a lump sum of the premium paid minus any income payments already dispensed.

Life with Installment Refund – Payments begin on the income start date, but upon Policy holders’ deaths, beneficiaries are guaranteed to receive remaining premium back in the form of installments.

For policies with Life with Period Certain, Life with Cash Refund, and Life with Installment Refund payout options, beneficiaries receive a return of premium if the annuitant(s) die before the income start date. Each annuity contract is different. Please confirm options and features that are available which may not be available in all state and insurance companies.

Why are Longevity Rates Higher than Other Fixed Investments?

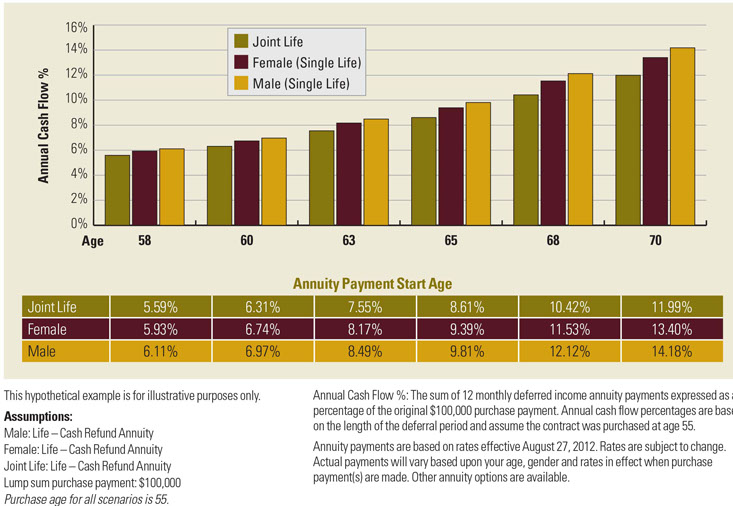

Longevity insurance and annuities pay income out later in life so with a longer deferral period will result in higher annuity payments and cash flow rates. See the chart below.

Longevity Insurance | LongevityInsurance.com | Contact Us Copyright 2012-13 Income Quote Longevity Annuity